Why LEGO Sets Make Good Investments

11%

Average Annual Appreciation

15-30%

Star Wars UCS Growth

LEGO has quietly become a legitimate alternative investment asset class. Unlike stocks or crypto, LEGO offers:

-

Tangible asset: Physical items you can enjoy before selling

-

Predictable patterns: Certain themes consistently appreciate

-

Low volatility: Doesn't crash during economic downturns

-

Diversification: Uncorrelated with stock market performance

Related guides: See which specific sets are most valuable or learn whether to keep sets sealed or open them.

LEGO Investment Performance by Category

Data Source: Based on BrickLink price history, secondary market sales analysis, and collector community data. Last Updated: January 2025. Past performance doesn't guarantee future returns.

| Category |

Average Annual Appreciation |

Hold Time |

Risk Level |

| Star Wars UCS |

15-30% |

3-5 years |

Low |

| Architecture Landmarks |

10-20% |

3-7 years |

Low |

| Large Icons (5,000+ pcs) |

12-25% |

3-5 years |

Medium |

| Modular Buildings |

15-20% |

5-10 years |

Low |

| Disney/Harry Potter |

8-15% |

3-7 years |

Medium |

| Creator Expert |

7-12% |

5-8 years |

Medium |

| Technic Flagships |

5-10% |

5-10 years |

High |

| Generic City/Friends |

0-5% |

10+ years |

High |

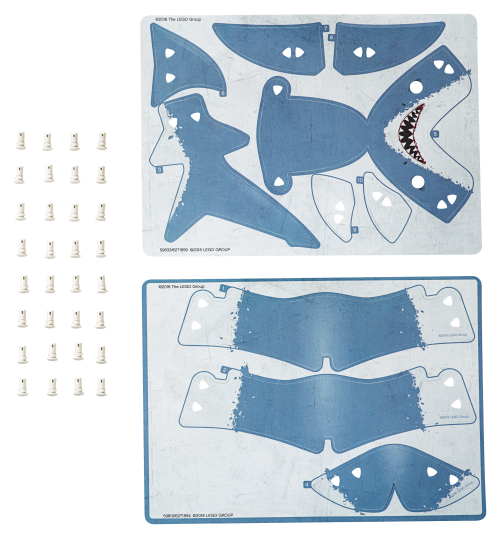

Top Investment-Grade Sets Available Now

Millennium Falcon

$849.99

Recreate epic space battles with incredible detail. A must-have for serious Star Wars builders and collectors.

Current Price: $849.99

Status: ✓ Currently Available

Expected 5-Year Value: $2,000-$2,500 sealed

Projected ROI: 135-195%

💡 Pro tip: Use the Buy Two strategy - build one, keep one sealed for investment.

Colosseum

$549.99

Experience an epic construction challenge with 9,036 pieces, recreating the grandeur of Rome's most iconic landmark. A rewarding build for architecture and history enthusiasts alike.

Current Price: $599.99

Status: ✓ Currently Available

Expected 5-Year Value: $1,200-$1,500

Projected ROI: 100-150%

The "Buy Two" Investment Strategy

How It Works:

- Buy 2 copies of investment-grade sets at release (at MSRP)

- Build one copy for display and enjoyment

- Keep second copy sealed in climate-controlled storage

- Sell sealed copy 3-5 years after retirement

- Profits typically cover both sets plus premium

Example: Buy 2x UCS Millennium Falcon at $850 each ($1,700 total). Build one for your collection.

Sell sealed copy for $2,000-$2,500 in 5 years. Net profit: $300-$800 + you keep the built set!

Storage & Condition Requirements

| Condition |

Relative Value |

Notes |

| Sealed, Mint Box |

100% |

Maximum investment value |

| Sealed, Minor Box Damage |

80-90% |

Shelf wear, small creases acceptable |

| Open Box, Unopened Bags |

60-70% |

Significant value loss |

| Built, with Box & Instructions |

40-50% |

Only collectors/builders interested |

| Built, No Box |

20-30% |

Minimal investment value |

Storage Requirements:

- Climate controlled: 60-75°F, low humidity

- No direct sunlight (UV fades boxes)

- Don't stack high (crushes boxes)

- Use box protectors for valuable sets ($20-50)

When to Sell: Timing the Market

-

Retirement announcement: Prices jump 20-30% immediately

-

6 months post-retirement: Peak demand spike (40-60%)

-

1-2 years post-retirement: Highest prices, most demand

-

3-5 years post-retirement: Stabilized appreciation curve

-

10+ years: Vintage premium for iconic sets

Risks & Warnings

-

Not guaranteed: Past performance doesn't guarantee future returns

-

Illiquid: Can take weeks/months to sell at desired price

-

Storage costs: Requires significant space

-

Counterfeits: Chinese knockoffs can devalue authentic sets

-

Trend changes: Theme popularity can shift unexpectedly

-

Tax implications: Capital gains tax may apply

Start Your LEGO Investment Portfolio

Browse investment-grade sets before they retire. The best time to buy is at MSRP, before secondary market premiums.

Browse Investment Sets →